Shortly after the Pakatan Harapan government came into power, they fulfilled their pledge to rid of the Goods and Services Tax (GST) that was implemented by the former Barisan Nasional government in 2015. Malaysians were pleased to experience a few tax-free months as the government prepared to reinstate the Sales and Service Tax (SST), which began on Sept 1, 2018.

One of the main benefits of the switch to SST was supposedly a higher disposable income (income remaining after deduction of taxes and social security charges, available to be spent or saved as one wishes), but it would also mean lower tax revenue for the country. Some of this would be offset by higher consumer spending, as consumers would presumably have more discretionary income (which is the money remaining from disposable income after paying necessary expenses like a mortgage, car payment, etc.), but there will still be a serious gap between what Malaysia collected in GST and what it will be able to collect in SST. So what are the differences between the two, and how will the country manage to cover this gap?

Goods and Services Tax (GST)

GST is a tax applied on most products and services for domestic consumption, where every stage in the production process is taxed, involving the manufacturer right up to the consumer. For example, the process of making a table might involve the raw material supplier (wood), a manufacturer who turns the wood into chip boards and then into tables, a wholesaler who buys the tables, possibly a distributor or supplier who delivers the tables to a number of different companies, a retailer who assembles the tables who then sells it to you. With GST, all the parties involved – the manufacturer, retailer, and consumer – would pay tax at their respective stage, add their margin, then move the product along to the next stage of the supply chain.

For businesses, GST can be claimed back as an input tax (tax imposed on business purchases and expenses, including the import of goods) for companies with revenue above RM500,000. However, due to sometimes significant margins being added at various stages along the supply chain, the ultimate tax paid by the consumer at the chain’s end could easily be 10 to 12%, as the tax is cumulative, not all businesses could claim back their input tax, and the next stage always attracted tax on the previous price plus the added margin! You can see why governments are so fond of this system, as it levies a series of taxes progressively as a product works its way through the supply chain. This tax system is the most commonly used form of taxation, with about 160 countries globally using this system, sometimes known as Value Added Tax (VAT) in other countries.

Benefits of GST

Because of its multi-stage, cumulative nature, GST ensures a higher tax revenue, which is good for the country as it increases the amount of money available to work on projects and developments that benefit the people. The system also allows for transparency of cash flow, allowing less opportunity for misappropriation of funds. It is also a favoured structure for conducting international businesses.

Cons of GST

Due to the multi-stage tax imposed on every level – from obtaining raw material right until the consumer – it was hard on consumers as prices went up as soon as GST was implemented, significantly increasing the cost of living for people. The implementation was also rather sloppy, with the list of GST-exempted or zero-rated items comprising both basic necessities and non-essential items such as lobsters.

From a business perspective, it was difficult for some businesses as they needed to make RM500,000 in annual sales before they were able to claim back GST for the tax paid by them in the production process, making it a labour-intensive exercise. Additionally, in some cases, claims were declined, too. There were also cases, some fairly well-publicised, where middlemen or retailers seized the opportunity to raise prices, using GST as a convenient scapegoat.

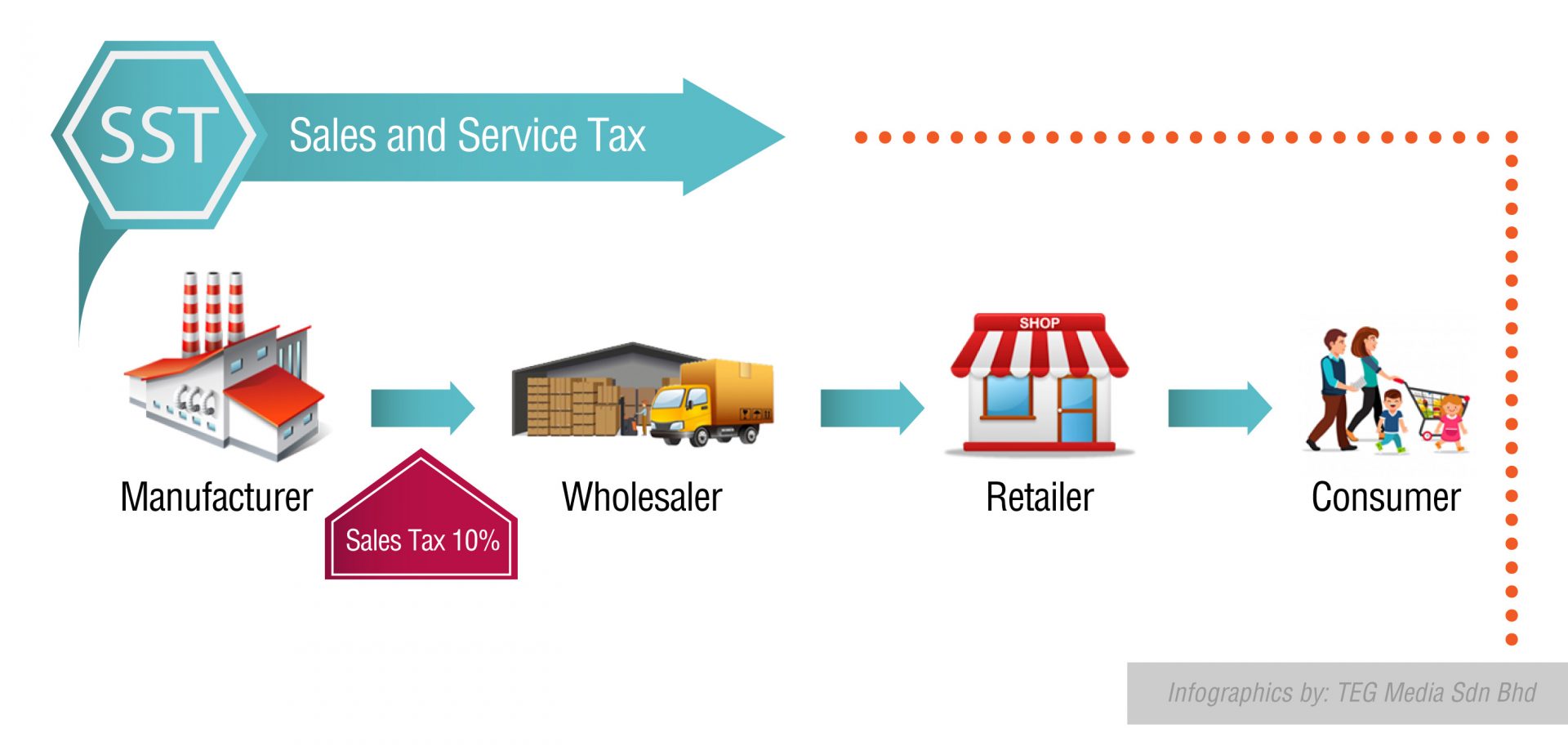

Sales and Service Tax (SST)

This is in fact two separate taxes covered by two separate tax laws on goods and services at a single level, which was implemented in Malaysia in the ’70s. Both taxes are single-stage taxes, whereby the sales tax (Sales Tax Act 1972) is typically charged at the manufacturer’s level while the service charge, or tax (Service Tax Act 1975) is charged at the consumer’s level, except at tax-free zones. The sales tax was at 10% and service tax was at 6% respectively prior to being replaced by GST in 2015.

Benefits of SST

The general consensus is that with SST back in the system, some prices have seen a decrease, but it remains to be seen whether prices will stay that way as there is still room for price adjustments. The single-stage taxation also means that businesses incur lower costs and that fewer businesses are impacted. Finance Minister Lim Guan Eng announced that the threshold for F&B providers is set at an annual turnover of RM1 million, meaning that those who operate with less than RM1 million turnover would not need to charge the 6% service tax. This also means that consumers potentially save a lot more on their discretionary expenditures.

Cons of SST

Other than the fact that the SST is considered a ‘less progressive’ form of tax, as most countries in the world practice the GST or VAT system, the implementation of SST will inevitably see the country’s tax revenue drop. In the shorter term, the switch back to SST will also be a burden to businesses which have to restructure systems, costing money and in turn, business instability. As for the decline in revenue, the current government has suggested that a significant portion of the shortfall realised in the change from GST to SST (estimated at up to RM20 billion annually) could be covered by eliminating wastage and reducing corruption at various levels of government and business.

What are your thoughts so far on the switch back to SST?

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "