It’s a different government, but when it comes to tourist- and travel-related matters, decisions being made seem just as self-defeating as those made by the previous government.

Though it didn’t directly impact Malaysians when imposed in 2017, the RM10-per-night-per-room tourism tax levied on visitors (and even expats who don’t have PR) staying in hotels in Malaysia wasn’t exactly met with enthusiasm, and we have heard of lost business and conventions, with groups choosing Bangkok over Kuala Lumpur, at least partly because of the added burden of paying RM10 per night for every room, every night, and every delegate. Many tourists don’t even know about the obscure charge until they check in at their hotel, at which point it’s well and truly too late. It’s a blatant cash grab, nothing more, because it’s evident that little, if any, of this money is being put into improving tourism infrastructure or attracting more tourists. If you want to appeal to tourists, who are already contributing significantly to the country’s GDP by coming to visit, don’t slap an additional tax on them just for the privilege of staying in a hotel here.

So that was a questionable decision made by the previous government, and one that’s regrettably still in force today.

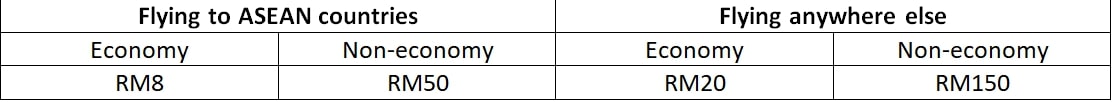

So imagine our dismay when the new PH government came along and made what’s possibly an even worse call related to travel! Finance Minister Lim Guan Eng lobbed the new tax broadside just last week, stating that effective on September 1, anyone departing Malaysia by air will have to pay a new levy, which ranges from RM8 to RM150.

Here’s the breakdown:

That’s right… even if you fly economy plus to Hong Kong, you’ll be hit with an extra RM150 on the price of your ticket.

Even worse for tourists, not only will be they gouged for money based on how long they stay in Malaysia, they’ll be dinged again when they leave. Taxed to come, taxed to leave. Is this any way to promote and grow tourism in a country that genuinely has a lot to offer visitors? It really makes us wonder what the thinking is behind the decision.

The supposed rationale for this tax, according to Lim, is to “encourage domestic tourism” – which apparently they think will be achieved by penalising anyone who dares to travel abroad. Netizens were predictably outraged, with many saying on social media that the levy imposes an undue burden on travellers and some predicting that PH would lose the next election if they kept making such poor decisions. Several comments we saw called for Lim to step down, with some questioning why the Finance Minister is putting a law into place that would seem to be under the purview of the Transport Minister.

We feel this is a bad move on several fronts. First, it rather echoes the old Proton business model. Instead of making a better car that could compete favourably with import models, the strategy to sell more Protons was simply to punish consumers for buying anything else – in the form of exorbitant duty on imported cars. How is this different? Instead of adding positive incentives to encourage people to travel domestically, the strategy is just levying a financial penalty if you travel outside of Malaysia. (And speaking of penalties, if you try to get around paying the levy, you can be fined up to RM500,000 and chucked into prison for three years, according to the Departure Levy Bill 2019. Nice!)

Second, what about people who travel internationally for business? Presumably, this sort of travel benefits Malaysia materially, as it stimulates foreign investment, cross-border sales, and more. So how does this levy help that? Imagine you run a business where your team members collectively take 60 international trips per year. Business is pretty good, so they usually fly “non-economy” – so this levy adds a wholly unnecessary RM9,000 to your expenses.

Finally, and this is perhaps the most problematic issue, the different departure taxes for those who fly economy and those who don’t just hints at a nasty sort of classism. You can almost hear the rationale: “If they can afford to fly business class, they can afford to pay RM150 instead of RM20!” Whether flying to ASEAN countries or beyond, those flying in any other class but economy are hit with a levy that’s nearly eight times higher than that of the economy class passenger flying on the same plane. That seems not only fundamentally unfair and wrong, but also something that’s almost certain to be challenged legally, and indeed, if not that particular aspect of the levy bill, the whole mess actually has been dragged into court.

In what is sure to be a popular move, a local lawyer is suing Lim and the federal government, claiming that the levy is unconstitutional and cannot be enforced. R. Kengadharan, in a summons filed at the High Court on August 8, maintained that the Departure Levy Act 2018 and the Departure Levy Order 2019 is a breach of citizens’ fundamental right to travel. He added that any additional tax imposed on top of the existing passenger service charges and airport taxes would be burdensome. Rough estimates of an additional RM1.1 billion per year being added to the government bank accounts as a result of the new levy would seem to support the claim of serious consumer burden.

In his affidavit to support the suit, he further noted that any form of tax imposed, including on those who wish to go on pilgrimages or to perform the Haj, is in violation of the liberties guaranteed in Malaysia’s constitution. However, some sources say the government is planning to offer exemptions to those travelling on pilgrimages, which raises an entirely new set of problems arising from questions of basic fairness and preferential treatment.

Once again, it appears a significantly impactful new policy is being rolled out in a seemingly haphazard and ill-communicated manner, with the consequences – and perhaps even the constitutional legality – not clearly thought out.

Travellers will no doubt be eagerly watching the outcome of the lawsuit to learn whether or not the levy will be imposed next month. We sure will be.

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "