The latest mobile payment system to roll out in Malaysia is one of the world’s biggest, but it’s only looping in three banks here to start, with more expected to be supported in the future.

With effect from November 15, Google’s mobile payment service has at last made its debut in Malaysia, joining both Apple Pay and Samsung Pay – services which were launched in August 2022 and way back in 2016, respectively – as contactless mobile payment options.

Google Pay, the service which is also known by the app’s name, Google Wallet, is by no means even remotely new. (“Google Wallet” and “Google Pay” are often used interchangeably – but they basically refer to the same thing, with Google Pay describing the actual payment method, and Google Wallet referencing the companion app.) In fact, it’s been available in the United States for more than a decade – and ExpatGo even wrote about the service over nine years ago, then lamenting the fact that, for all practical purposes, the payment option wasn’t available in Malaysia yet.

Well, apparently somebody in Google’s Silicon Valley headquarters got wind of the fact that a country in Southeast Asia called Malaysia exists, and that it is filled with millions of Android smartphone users, and so now, a little over 11 years after the Google Pay platform was initially released, it’s finally come to Malaysia, following its rollout in some 45 other countries, some as obscure as Latvia, Moldova, Kyrgyzstan, and Cyprus.

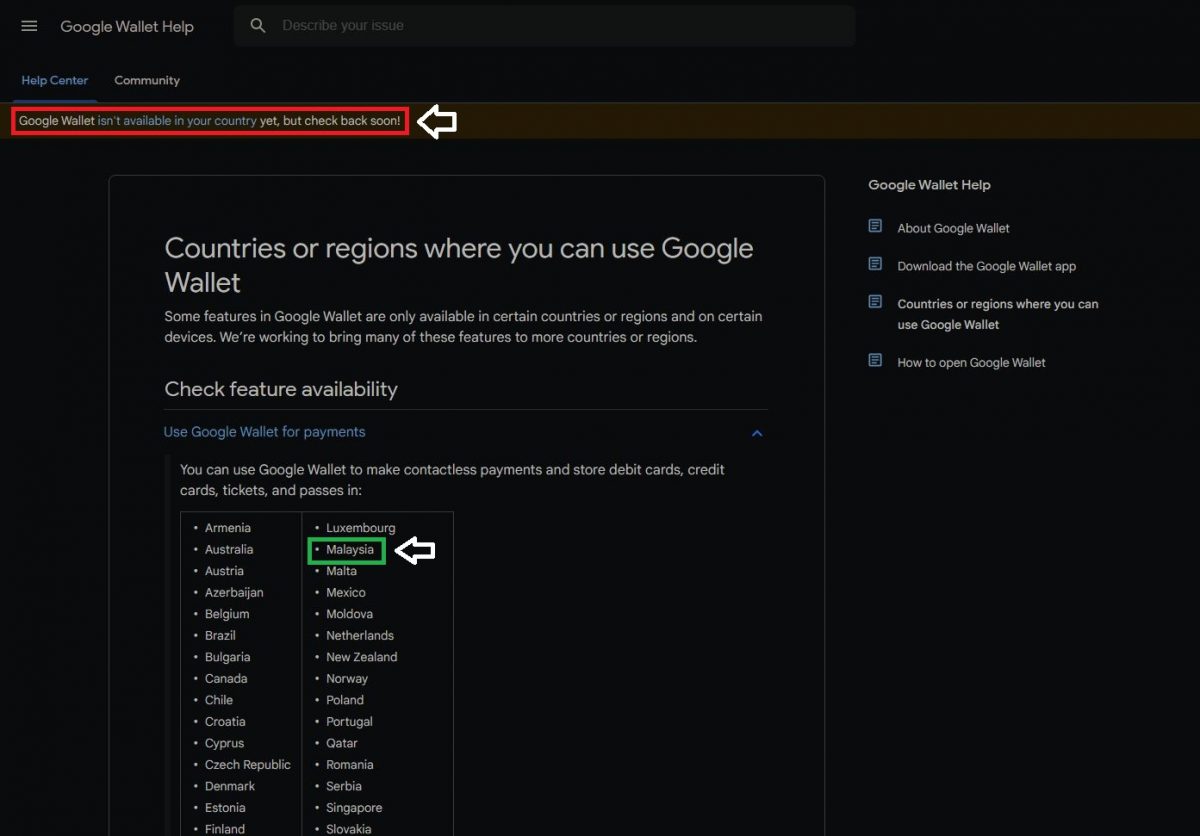

Even now, when you visit Google’s support page, despite Malaysia being listed in the line-up of countries where Google Wallet is available, the site still insists (on the same page) that “Google Wallet isn’t available in your country yet.” The lack of respect for Malaysia from Google, whose coveted Pixel smartphones still aren’t legitimately sold here, is palpable.

Google Pay isn’t quite the same as an e-wallet, such as those offered by Touch ‘n’ Go and other providers in Malaysia, so read on to learn the distinct differences in these payment options.

As explained by Google, users with supported cards will be able to save their card details in the Google Wallet app on their Android device, and that includes wearables running on Google’s Wear OS, such as the Samsung Galaxy Watch 5 or the Pixel Watch.

Following set up, the user’s device – either the phone or watch – can then be used to make offline payments via NFC (near field communication) with just a tap – and the physical contact of the ‘tap’ isn’t required: just get it close enough – and even online payments for websites that support Google Pay as a payment option, such as Shopee.

The Google Wallet app also has the option for users to add AirAsia boarding passes that have been purchased via the airline’s app by simply tapping on the “Add to Google Wallet” button. Support for Malaysia Airlines boarding passes will also be added in the coming months, according to the press release, and we wouldn’t be surprised to see more transportation options opening up in the future. Just imagine the ease and convenience of using your smart phone or smart watch to pay your bus fare or to tap the entry gate at the LRT station before boarding the train and awaiting its inevitable breakdown 15 minutes later.

Humour aside, though, for airline use, when any boarding pass is added to the Google Wallet app, users will receive notifications for any changes to their flight departure times and/or gate changes to make for a smoother experience at the airport.

AirAsia has already gotten on board (no pun intended), with support extended beyond its various flight services to its broader ‘super app’ payment system. Malaysia Airlines has stated it will soon offer support for Google Wallet, too.

Perhaps a bit unfortunately, Google’s mobile payment service is not arriving on the Malaysian scene with a huge, bold splash, but is rather taking a more drip-drip-drip approach. At launch time, the service is only supported by three measly banks: CIMB, Hong Leong, and Public Bank. HSBC and HSBC Amanah are expected to join the roster “in the coming months.”

Notably absent from the list is Maybank, and for CIMB, another large bank, only credit cards are supported now, not debit cards. At launch time, it appears Hong Leong offers the most comprehensive support, including both MasterCard and Visa cards, each of both the credit and debit variety.

Currently supported cards for Google Pay

- CIMB (MasterCard Credit)

- Hong Leong Bank and Hong Leong Islamic Bank (All Visa and MasterCard Credit and Debit)

- Public Bank (Visa Credit, Debit)

Available in the coming months:

- HSBC (MasterCard Credit, Visa Credit)

- HSBC Amanah (MasterCard Credit, Visa Credit)

It will be good to see this popular mobile payment application expanded in Malaysia. Plenty of netizens are expressing frustration and disappointment that the launch is limited to so few banks. However, as more banks are supported and more businesses begin accepting Google Pay as a way to pay for goods and services, we feel this will be a very welcome addition to the growing landscape for payment options, which now includes cash, credit cards, debit cards, e-wallets, and mobile payment apps.

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "