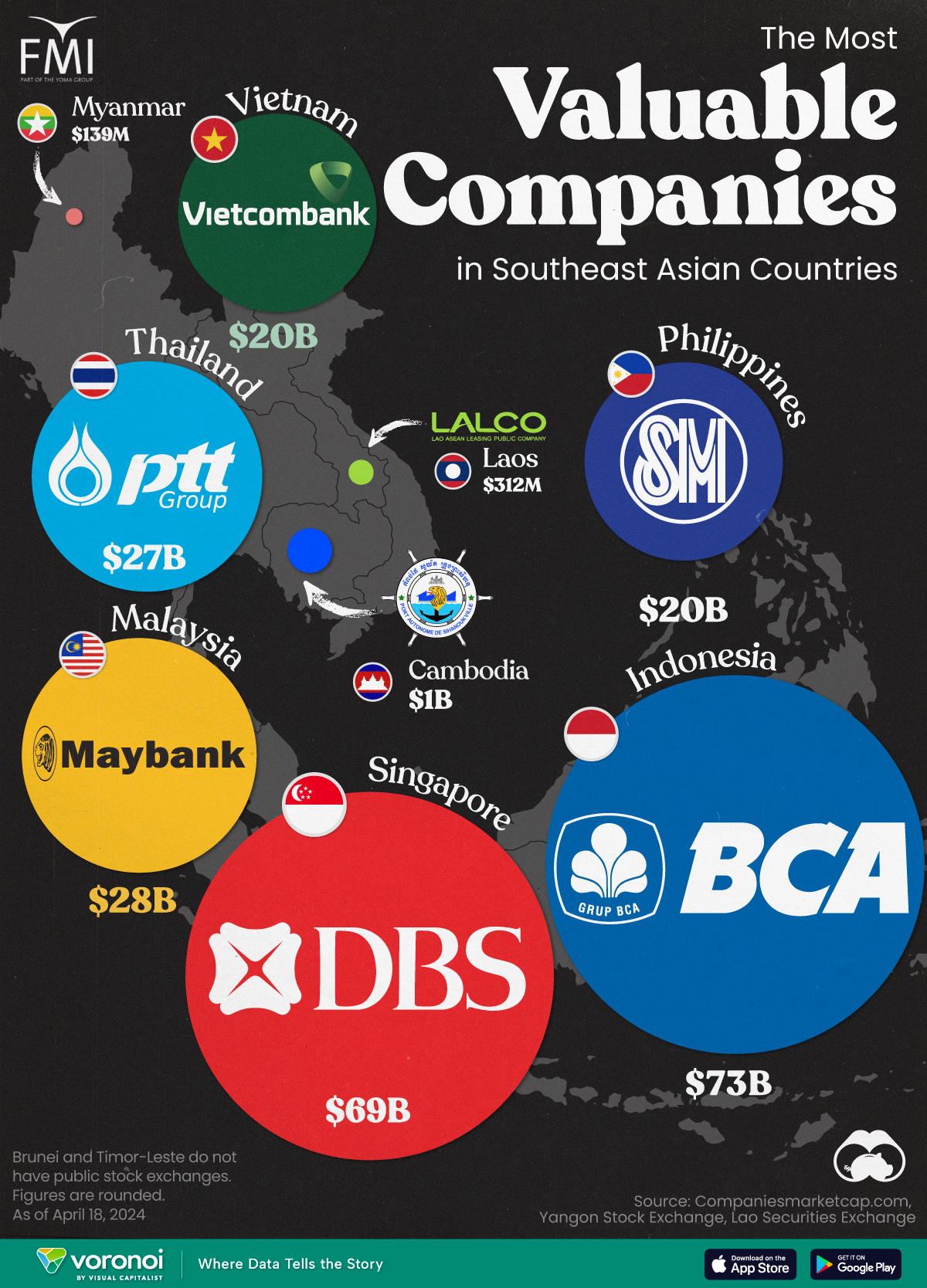

What’s the most valuable company in Southeast Asia? In Malaysia? A recent infographic from Visual Capitalist puts it all in perspective.

Southeast Asia has emerged as a significant economic force in recent years, although the disparity among the region’s largest publicly traded corporations is striking. In some ways, this mirrors the economic realities of each country, which are considerably varied. But there are a few surprises, too.

IDENTIFYING ASEAN’S LEADING COMPANIES

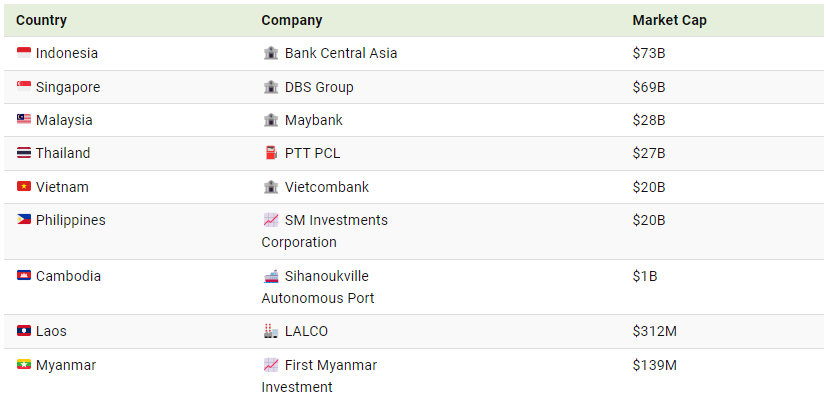

As of April 2024, analysts set out visualise the most valuable company in each Southeast Asian country, measured by market capitalisation in current U.S. dollars.

BANKS DOMINATE

Indonesia’s Bank Central Asia and Singapore’s DBS Group, both banks, lead the pack, each valued at a market capitalisation near $70 billion.

Incredibly, with BCA at $73 billion and DBS at $69 billion, each of these two companies (excluding the other) boasts a greater market value than that of every other ASEAN country’s most valuable company combined ($68.451 billion).

In Malaysia, Thailand, Vietnam, and the Philippines, the largest companies hover around the $20 billion mark, with two of the four being banks.

Malaysia’s most valuable company is Maybank, with a market cap near $28 billion. In comparison, the country’s other major bank, CIMB, had a market cap of $15.2 billion as of early May 2024.

Cambodia’s Sihanoukville Autonomous Port stands alone in the list of figures, with its market value pegged at $1 billion.

Elsewhere, Laos’ LALCO, a credit leasing entity, commands a worth of $312 million, while Myanmar’s First Myanmar Investment holds sway at $139 million.

UNIQUE DIFFERENCES IN BRUNEI AND TIMOR-LESTE

You may have noticed not every ASEAN country is shown. That’s because two of them don’t have public stock exchanges, though for different reasons.

Brunei’s economy leans heavily on its state-owned oil sector, a factor contributing to its ruler’s status as the world’s second-richest monarch. In contrast, Timor-Leste’s small population and limited access to credit and liquidity have hindered the establishment of publicly listed companies or an exchange.

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "