A Hire Purchase agreement involving vehicles principally is an agreement to rent the vehicle and also to purchase it at a later time. In a hire purchase agreement, you agree to hire the vehicle until you fully pay off what you owe.

The glitches happen when the hirer cannot afford the instalments, which may lead to repossession. Also, keep in mind that your guarantor will be liable for your non-payments.

Hire Purchase – Default in Payment and Repossession

When you “default” on your hire purchase agreement, it means you have failed to fulfil your commitment to the bank. When this happens, the bank can repossess your car. Generally, repossession can happen when:

- You fail to pay for two consecutive month’s payment, or when you fail to pay your last payment, and

- In the case where the hirer is deceased, a default in payment for four months gives the bank the right to take possession of the car.

So, be prompt in your payment or you might also have to pay penalty fees. If in any case, you think you’re unable to pay the instalments, a good tip is to quickly contact your bank for a solution.

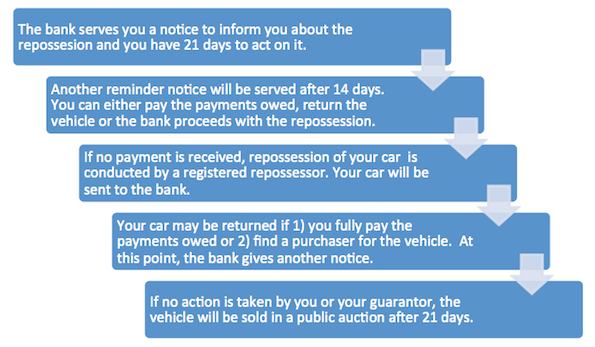

The Procedures of A Lawful Car Repossession by the Bank

Manner of Repossession

Sometimes there are oppressive measures taken. For example, we have all heard about “thugs” sent to repossess vehicles or selling off the car in a way cheaper price. Of course, legal actions can be taken if the repossession procedures are not in line with the Hire Purchase Act 1967.

This article was written by Ching Wei Lee of iMoney

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "